Taxpayer contributions allow Vancouver Public Schools to provide an extraordinary education to students, employ local workers, sustain property values by helping to keep Vancouver neighborhoods desirable places to live and build/maintain facilities that serve the community.

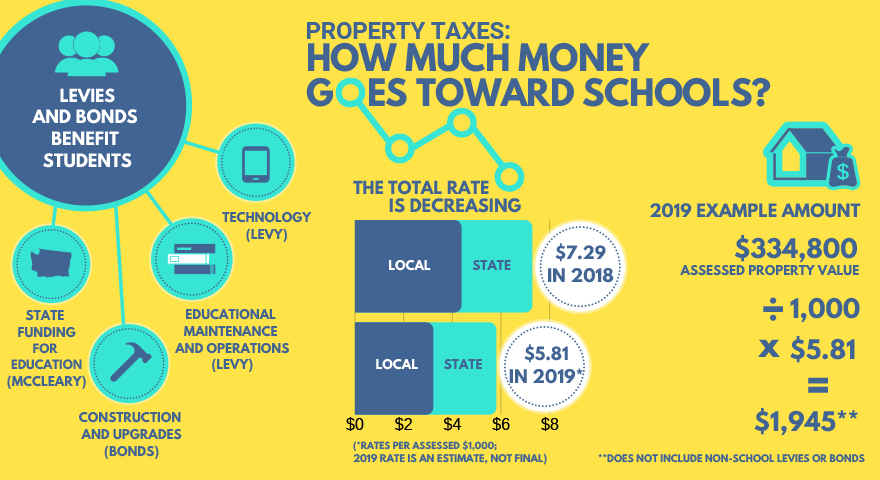

Vancouver Public Schools receives tax dollars from different sources.

Local level

In previous years, local voters said yes to two levies and two bond measures that will affect the amount that property owners see on their 2019 tax bills:

- Technology and educational maintenance and operations levies approved in 2013 and 2017 (both expiring in 2019)

- Bond measures approved in 2001 (will be retired in 2020) and 2017

State level and the levy swap

A state school tax provides funding for Washington school districts.

In 2018, the state increased its school tax rate and redistributed the money all over Washington to satisfy its constitutional obligation to fund basic education. Local school levy rates were not affected.

In 2019, the state will maintain its school tax rate. Local educational maintenance and operations levy rates will be capped at $1.50 per $1,000 of assessed property value. (The 2018 educational maintenance and operations levy rate for VPS is $2.64.) This change, known as the levy swap, won’t affect school bonds.

The Vancouver Public Schools board of directors approved two levies—a replacement technology levy and education and operations levy—that will appear on the ballot for voter consideration in the Feb. 12, 2019, special election.

BONDS = BUILDINGS, LEVIES = EDUCATION AND OPERATIONS

Levies and bonds are used for different things. Levy dollars pay for educational programs and day-to-day operations of schools, including:

- Classroom supplies

- Technology

- Extracurricular activities

- Utilities and insurance

- Teachers and staff

- Safety and security personnel

Levies regularly must be reauthorized.

Bonds pay for facilities, including:

- New construction

- Replacement schools

- Building and grounds upgrades, e.g., new roofs, heating and cooling systems and turf fields

- Secure entrances

- Remodeling/expansion

Bonds cannot be used to pay for operations.