Replacement technology, safety, and capital projects levy

Our VPS board of directors passed a resolution to place a replacement technology, safety and capital projects levy on the February 11, 2025 ballot. This is not a new tax, it replaces an expiring levy, and can only be used for capital projects. We wanted to share some facts about the intent of this levy and what it will support.

Technology, Safety, and Capital Projects Levy on February Ballot

Our VPS board of directors passed Resolution No. 928, placing a replacement Technology, Safety, and Capital Projects Levy on the ballot for February 11, 2025. Here’s what you need to know:

This levy replaces our existing technology-focused levy and expands its purpose to include:

- Technology, replace and maintain future-ready digital tools and infrastructure that prepare students for modern learning and career opportunities.

- Safety improvements, like secure entrances and updated safety systems

- Building system repairs to extend the life of existing facilities (e.g., HVAC, roofs).

To fund specific needs, such as technology and building improvements, that are not fully covered by state and federal funding.

- Capital Project Fund (CPF) levies like this cannot be used for classroom staffing or general operations. They are limited to facility, equipment, and technology needs.

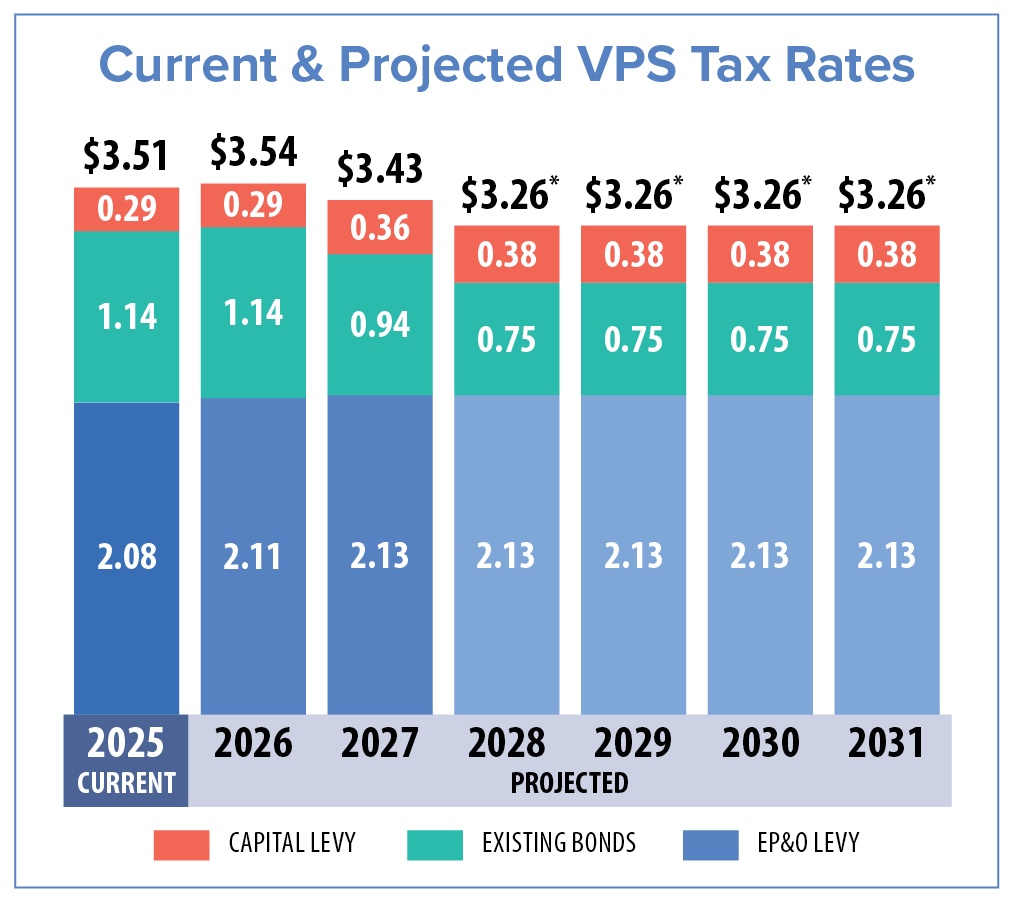

The estimated levy rates* are:

- $0.29 per $1,000 of assessed property value in 2026.

- $0.36 per $1,000 in 2027.

- $0.38 per $1,000 from 2028 through 2031.

Tax rates from previously approved bonds are expected to decrease in the future, meaning the total VPS tax rates are intended to remain consistent over time.

*Future tax rates are estimates and fluctuate due to changes in property assessments and area growth.

Critical funding would be lost for:

- Updating aging technology tools and infrastructure.

- Safety improvements, such as secure entrances and upgraded surveillance systems.

- Repairs to extend the life of buildings, such as HVAC and roofing projects.

There may be challenges maintaining current safety and technology standards

Necessary maintenance and upgrades may have to be deferred–potentially resulting in higher repair costs and affecting students’ learning environments and safety.

Current investments in future-ready technology and services may not be sustained, potentially limiting VPS’s ability to prepare students for modern learning and career opportunities.

This is a six-year replacement technology, safety and capital projects levy that would go into effect January 2026 and would expire December 31, 2031. This replacement levy will replace the current six-year technology levy that expires in 2025.

- The levy will provide continued investment in necessary future-ready technology and safety projects.

- It will help maintain and extend the reliability of school facilities through 2031.

- The levy will allow the district to address emerging safety and infrastructure needs without increasing the total tax burden for local taxpayers.

This resolution, adopted on November 12, 2024, is designed to support the Vancouver Public Schools’ long-term and future needs for safety, technology, and building functionality.

*Rate assumptions hold E&O Levy rates consistent for longer-term modeling purposes, but that levy expires after 2027. The board may determine different E&O amounts for voters to consider, but not until 2027.

Tax rates are per $1,000 assessed property value. Future tax rates are estimates. Rates may fluctuate based on property valuations, but the district can only collect the amount approved by voters for each year.

Please take a minute to share any questions you may have about this replacement levy. We will use the questions we receive to build a FAQ list.